Rumored Buzz on Data for Amibroker

Rumored Buzz on Data for Amibroker

Blog Article

Place your data over a SSD push (or buy a SSD push to switch your most important system generate). Your exploration will run about eight situations quicker. Avoid your virus scanner from doing authentic-time scanning of both of those AmiBroker Database and the actual data storage locations (e.g. C:Plan InformationAmiBrokerASX-PremiumData and C:Buying and selling Data). Due to the fact there isn't any executable courses in these folders, scanning them is superfluous. Your exploration will operate close to two instances more rapidly. Click Resources > Choices then click on the Data tab. In case you enhance the In-memory cache size to 20000 (max symbols) that should include development In this particular spot for quite a while. 20000 is the most Restrict in just AmiBroker. The Max MegaBytes will also be increased. Perhaps attempt growing this to 1000MB (For those who have at the least 2GB of RAM) and enhance even more In case you have far more RAM.

Assuming you may have acquired historical data for US delisted, and have already got the data put in, stick to these ways:

In the best A part of the dialog it is possible to see "Preset" combo-box. As of now it allows to pre-set the fields employing two generic techniques:

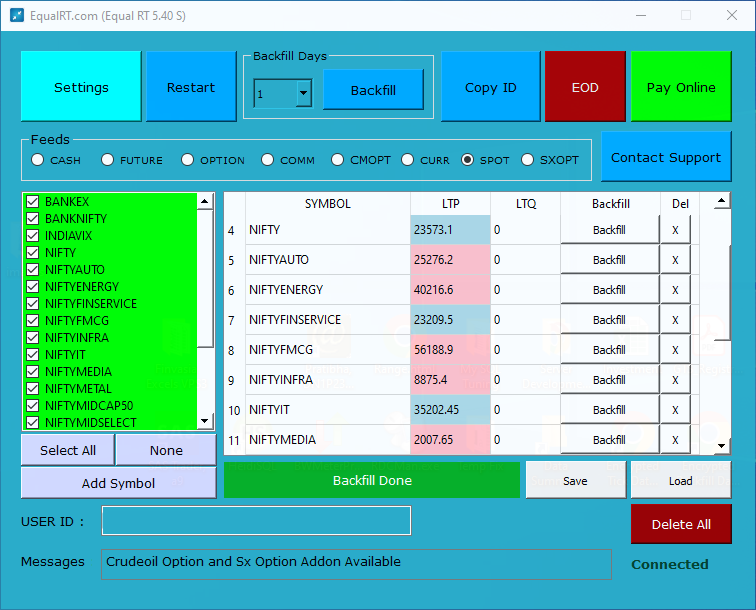

As for "automatic backfill on very first data accessibility" - when it really is checked AmiBroker makes an attempt to backfill symbol whenever you Show a chart for offered symbol (or perform backtest or scan).

+ take care of to "replicate ticker ID" error occuring with newest TWS when much more than five day backfill was asked for

This allows to acquire quotations for some alternatives which have pretty lengthy symbols (exceeding 26 figures authorized by AB).

It truly is practical to get this option turned on, however it could potentially cause supplemental load on your own internet connection due to data required to be downloaded through backfill approach.

At times when you find yourself backtesting with data that includes delisted stocks, you end up with an open posture that is rarely shut. Here is some code that should be added to your investing procedure to simulate exiting the situation on the ultimate bar:

IQFeed core products and services start off at $99 every month for US and Canadian exchanges. You’ll must buy an insert-on subscription with the F&O data membership.

So it truly is advised to utilize this aspect responsibly and never anticipating getting 500 symbols though your subscription is restricted to only fifty. Be aware that the above mentioned system doesn't implement to real time Data for Amibroker estimate window and it can't keep much more symbols than your membership Restrict.

Problem was that IB often repeats persistently exactly the same tick and from time to time skips some ticks and cumulate them into one tickSize LAST_SIZE occasion.

In the event your data resource supports blended EOD/Intraday manner (such as eSignal or IQFeed) You should use single database for each varieties of charts.

You could reference the watchlists by identify. To accomplish this, place a filter into your scans/explorations with:

In AmiBroker You can find an option under the Check out menu to "Pad non-buying and selling times". For those who uncheck this your charts will go back to regular.